florida estate tax exemption 2020

Florida Estate Tax Exemption 2021. Florida Estate Tax Exemption 2021.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

The 2020 limit after adjusting for inflation is 1158 million.

. Ad Valorem Tax Exemption Application and Return for Multifamily Project and Affordable Housing Property N. To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers Certificate of Exemption Form DR-14 from the Florida Department of Revenue. Ad Valorem Tax Exemption Application and Return For Nonprofit Homes for the Aged R.

Application for a Consumers Certificate of Exemption. Ad Download Or Email Form DR-312 More Fillable Forms Register and Subscribe Now. Ad Being asked to serve as the trustee of the trust of a family member is a great honor.

We also offer a robust overall tax-planning service for high. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. The homestead tax exemption in florida can result in significant property tax savings.

The Tax Cuts and Jobs Act raised the lifetime gift and estate tax exemption. Federal Estate Taxes. The federal government however imposes an estate tax that applies to all United.

So even if you qualify for the federal estate tax exemption An individuals leftover estate tax exemption may be transferred to the surviving. Ad Download Or Email Form DR-312 More Fillable Forms Register and Subscribe Now. DOC 63 KB PDF 96 KB DR-504CS.

Miami Dade Homestead Exemption Form Fill Online Printable Fillable from. The Estate Tax is a tax on your right to transfer property at your death. Economic Development Ad Valorem Property Tax Exemption section 1961995 FS PDF 446 KB DR-418C.

196031 Exemption of homesteads. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. As of 2016 the following Estate and Gift tax exemptions are in effect.

Posted on April 28 2016 December 9 2020. Estate and Gift Tax Exemptions for 2020. Florida estate tax exemption 2020.

The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is. But being a trustee is also a great responsibility. Real property evaluations are carried out by the county.

Due to inflation the estate tax exemption has risen this year to 126 million dollars. As mentioned Florida does not have a separate inheritance death tax. Ad Valorem Tax Exemption Application and.

So even if you qualify for the federal estate tax exemption An individuals leftover estate tax exemption may be transferred to the surviving. 1121 section 1961975 FS PDF 174 KB DR-504W. Real Property Dedicated in Perpetuity for Conservation Exemption Application.

Registration Application for Secondhand Dealers andor Secondary Metals Recycler and instructions. The 2020 limit after adjusting for inflation is 1158 million. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is.

The exemption amount will rise to 51 million in 2020 71 million in. 1 a A person who on January 1 has the legal title or beneficial title in equity to real property in this state and. Ad Valorem Tax Exemption.

Florida Estate Tax Exemption 2022.

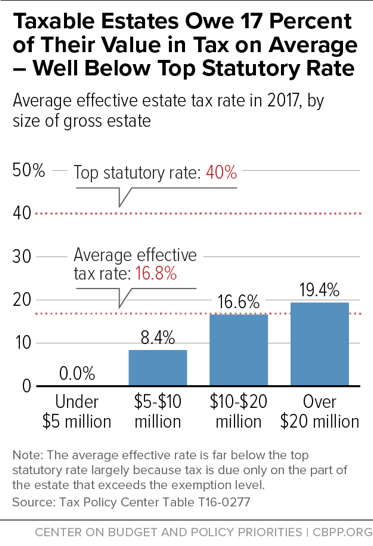

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

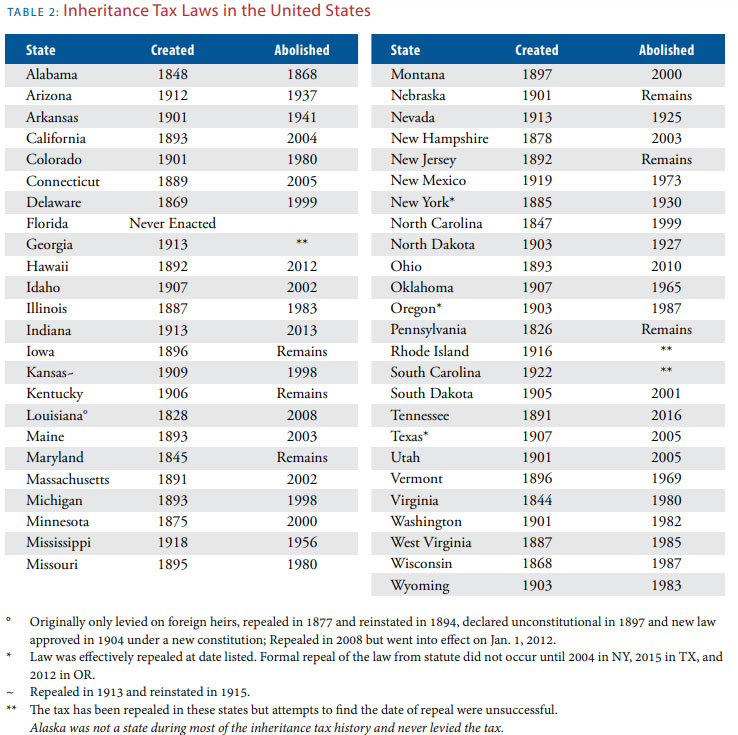

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

What Taxes Do I Have To Pay If I Receive An Inheritance In Florida St Lucie County Fl Estate Planning Attorneys

Florida Estate Planning For Non Citizens Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Homestead Exemption Application Deadline Asr Law Firm

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Inheritance Tax In Florida The Finity Law Firm

Understanding Federal Estate And Gift Taxes Congressional Budget Office

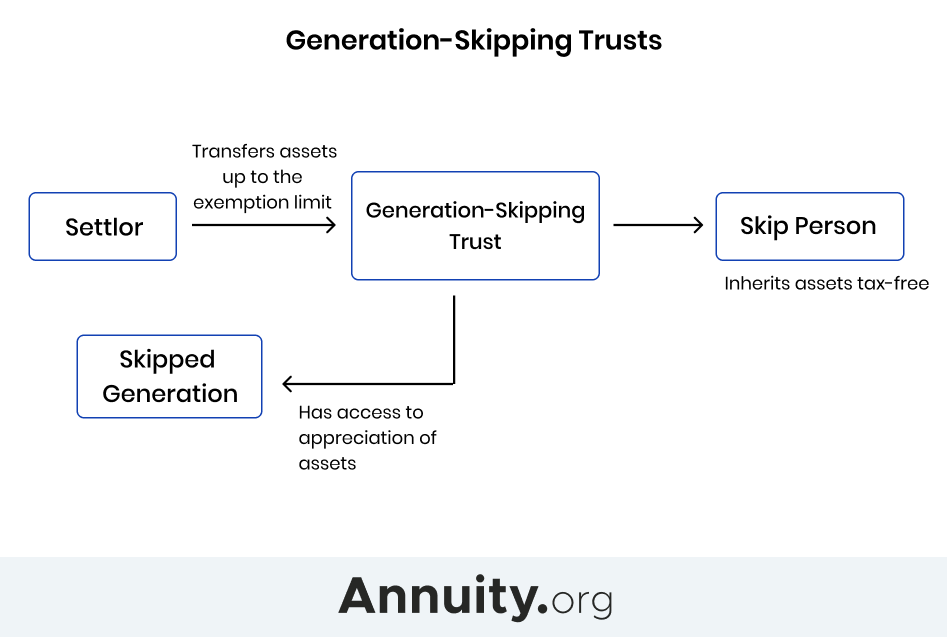

Generation Skipping Trust Gst What It Is And How It Works

5 Tax Deductions For Florida Homeowners Michael Saunders Company

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Desantis Delivers An Estate Tax Savings Gift For Floridians

Does Florida Have An Inheritance Tax Alper Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Estate Tax Rules On Estate Inheritance Taxes

Florida Attorney For Federal Estate Taxes Karp Law Firm

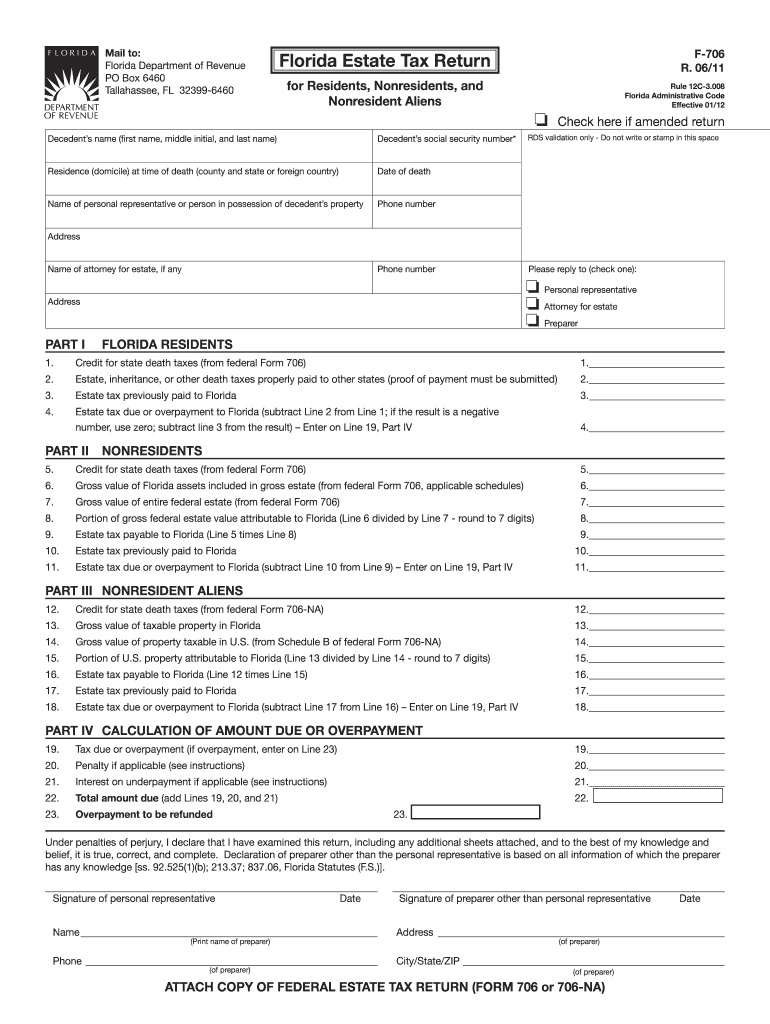

Florida Estate Tax Return F 706 Fillable Online Form Fill Out Sign Online Dochub